Investment markets have arrived at the start of 2021 on a high, on the back of what has been a most unusual year by any measure.

The last twelve months has shown us once again that investment markets move in anticipation of the future, rather than the present, and that it is important to have a diversified portfolio and not to time the markets. It also shows us that there are opportunities to make money and, as we conclude at the end, this can be done whilst considering the environmental, social and governance impact of your investments.

Looking back at 2020

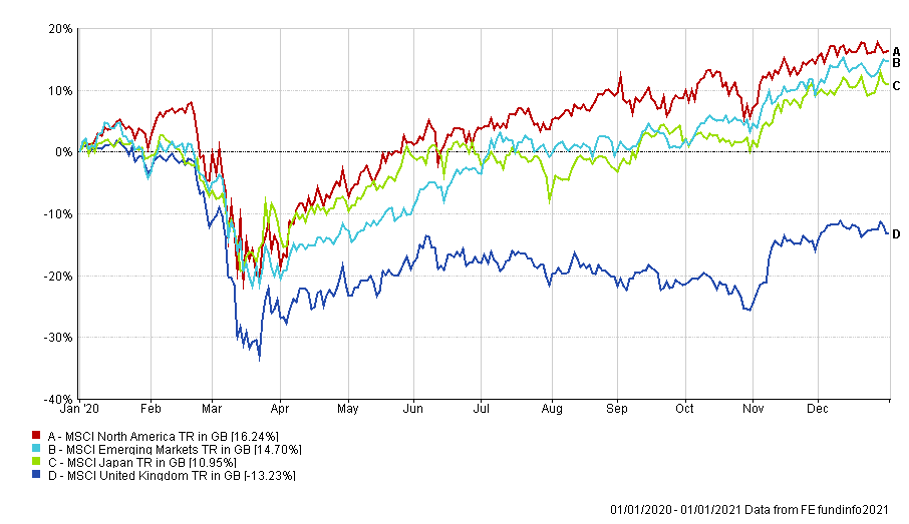

Take the below performance figures for various equity markets as an example:

| Index | 2020 Performance (%) |

| MSCI North America | 16.24 |

| MSCI Japan | 10.95 |

| MSCI Emerging Markets | 14.65 |

| MSCI United Kingdom | -13.23 |

The above table fails to capture the full picture and the volatility which was present. Markets experienced near-record falls and rises in the span of months, and in some cases weeks.

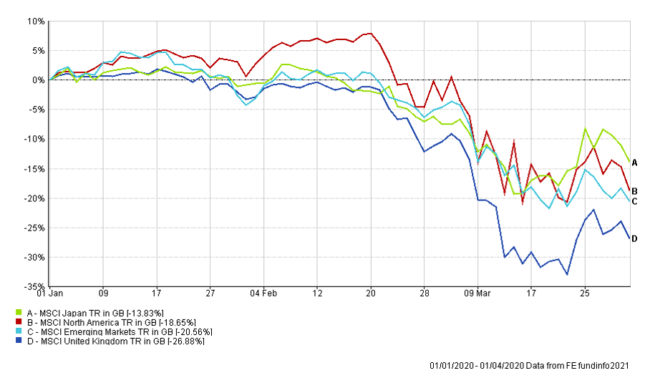

The year started on a positive note for investment markets. However, as we all know news stories began focusing on the growing outbreak of Covid-19 in the city of Wuhan, China. As the virus spread around the world markets panicked and investors rushed to sell assets fearing the economic impact of potential measures to control the virus.

From mid-February to the end of March markets fell in value by around 20%, with the UK down 30%. It was at this point that daily life completely changed as the UK entered its first lockdown. As the economy shutdown, perhaps counterintuitively markets responded positively to the news and this moment was the beginning of the recovery.

What drove the recovery in the markets?

The biggest reason for this reaction is the substantial level of support by Governments and Central Banks. Policies such as the furlough scheme in the UK have been deployed across the globe alongside unprecedented levels of Central Bank support. These together have supported economies and without which it is likely unemployment would be much higher and more businesses would have failed.

As the year moved on, markets continued a volatile but upward climb. The UK struggled in this time as large companies in the index are in industries most impacted by the effects of lockdown. These include energy, where global demand reduced heavily as activity was disrupted, and banks, which had to contend with a further lowering of interest rates.

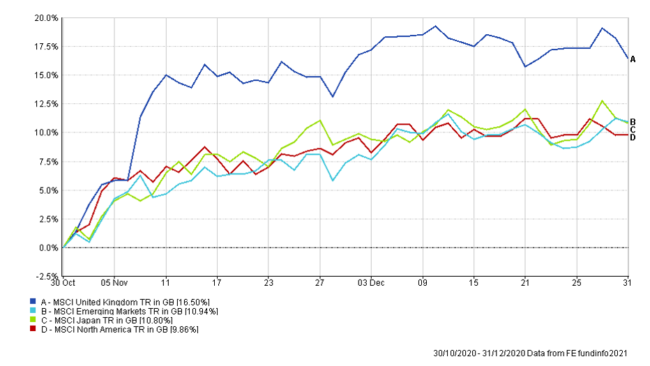

November changed this direction with the news of multiple promising vaccines. This period saw near record-breaking growth in the UK on the hope of a return to ‘normal’ that a vaccine could potentially deliver. Equity markets ended the year positively even as Donald Trump contested the outcome of the US Presidential election and Brexit negotiations went down to the wire.

We wrote back in April about the importance of staying invested and that it is time IN the market, not timing the market that was important. This adage fared well for investors as the performance of investments in 2020 shows. It is of course concerning when the value of your portfolio falls, it is only human to feel some sense of anguish. However even in the face of unprecedented circumstances investment markets once again rewarded investors who held on to their investments. There is no guarantee that markets will continue performing like this but historically markets have rewarded investors who stayed the course.

Environmental, social, governance – the rise of ESG investing

A growing investment theme in 2020 was the rising popularity of ESG investing. The level of information available to humanity has never been so great and this has increased awareness towards issues affecting society and the planet. ESG investing seeks to invest in companies which are making a positive difference towards these issues. For example, environmental focused funds invest in companies seeking to promote sustainability and who are combating climate change. Other funds invest in companies tackling social issues through their products or practices, for example acting to decrease inequality wherever it may arise.

A criticism in the past of this type of investing was that it reduced opportunities for investment, and returns could potentially suffer as a result. With changing consumer preferences towards sustainable and ethical living, these criticisms may no longer apply. In 2020, Global ESG screened investments marginally outperformed their non-ESG counterparts, and while there is no guarantee this order will continue there is growing appetite for this style of investment.

Invitation

With increasing demand, there is a growing range of products and solutions to meet these needs. As a result of these greater opportunities Vesta Wealth is proud to be expanding its DFM service, to offer an ESG portfolio focused on these ethical stances. The portfolio will be launched in February 2021 exclusively for our clients and will follow a balanced level of risk.

Please speak to your adviser to learn more about the portfolio and whether it might fit in with your financial plan. Get in touch with your Financial Planner here at Vesta Wealth in Cumbria, Teesside and across the North of England.

Reach us via:

t: 01228 210 137

This content is for information purposes only. It should not be taken as financial or investment advice. To receive personalised, regulated financial advice regarding your affairs please consult your Financial Planner here at Vesta Wealth in Cumbria, Teesside and across the North of England.