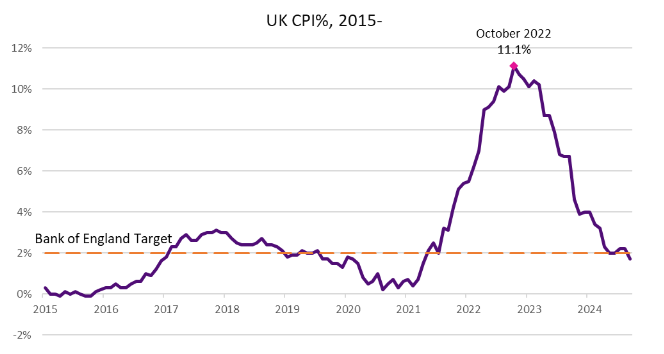

The UK economy received some welcome news mid-month, with the Consumer Prices Index (CPI) measure of inflation for September falling to 1.70%. This was down from the August print of 2.20%, and is the lowest headline inflation reading for over three. For future interest rate decisions, it brings the rate below the Bank of England’s target of 2.00%. The September reading normally carries additional significance, as it is referenced for benefit payment increases.

The largest downward contributors were transport, in particular airfares and motor fuels, with some upward pressure from food and non-alcoholic beverages. Core CPI, excluding energy, food, alcohol, and tobacco, eased from 3.60% to 3.20%. CPIH, which includes owner occupiers’ housing costs, a metric which is due to replace the Retail Prices Index (RPI) for the referencing of index-linked gilts by 2030, was recorded at 2.60%, down from 3.10% the prior month.

So more cuts to interest rates?

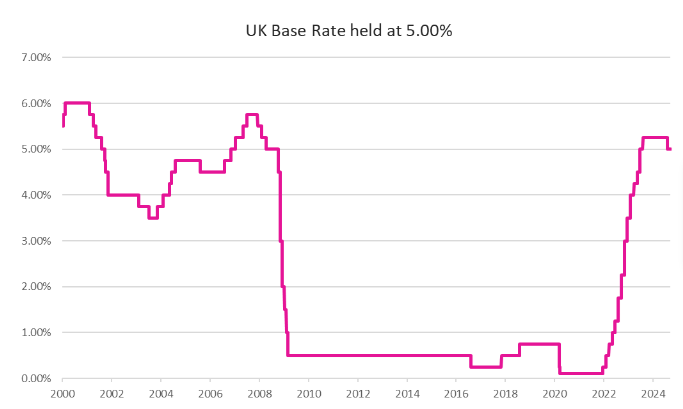

The improved landscape for inflation has sharpened anticipation that the Monetary Policy Committee of the Bank of England will vote for a further cut to the base rate at the forthcoming November meeting. Speaking at an event in Washington DC on the 23rd of October, Governor, Andrew Bailey, noted that inflation had fallen faster than expected. Indeed, in the September inflation reading, deflation in goods deepened from -0.90% to -1.40%.

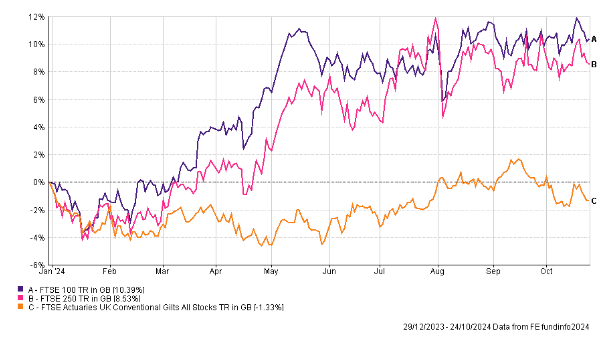

Gilt yields initially fell after inflation figures were released but have since risen steadily, with the 10-year yield passing 4.25%. While yields have been rising globally, in the UK, this can be partially attributed to the impending UK Budget due to be delivered by Chancellor Rachel Reeves on 30 October.

Eyes on the Budget

The budget, the first to be delivered by the new Labour government, has attracted considerable speculation. Labour have stressed the need to increases taxes to plug a suggested fiscal blackhole of over £20bn. While there have been indications about the rewriting of the UK’s debt rules to potentially free up £50bn to spend on infrastructure projects. For UK investors, the uncertainty on policy changes has introduced an element of caution.

This is one factor that can be considered as contributory to a surveyed slowdown in private sector activity. The Flash UK PMI Composite Output Index reading fell to 51.70, the lowest reading in almost a year, down from the September recording of 52.60. While representing a slowdown in comparison to previous months, this still represents growth.

Earlier in the month, official figures reported that government borrowing in September reached £16.60bn, the third highest reading for the same period since records began in 1993. The Office for National Statistics (ONS) attributed the figure to higher interest payments and public sector pay increases. Whilst the budget is an opportunity for the government to outline its plan to increase the growth rate of the economy, it must be delivered in a fiscally responsible framework to avoid unsettling financial markets.

Global Markets

Investor focus is also turning towards the upcoming US Presidential Election. Polling suggests the vote will be very tight, hanging on a handful of swing states. In the short-term, markets can be expected to be volatile amidst uncertainty of which candidate might win and the policies they might enact. However, in the long-term investment markets show little regard for the incumbent in the White House.

In a similar tone to the UK, the bond market is paying close attention to the spending plans of both Vice President Harris and Former President Trump. Despite the Federal Reserve commencing its interest rate cutting cycle with a larger than usual 0.50% cut to a range of 5.00%-4.75% in September, bond yields have been notably rising with the 10-year treasury yield moving above 4.20%.

US equity indices have been more relaxed, buoyed by robust corporate earnings, and reached new highs during the month. This was typified by electric vehicle manufacturer, Tesla, as the company comfortably beat third quarter profit estimates and gave a bullish outlook for growth in 2025.

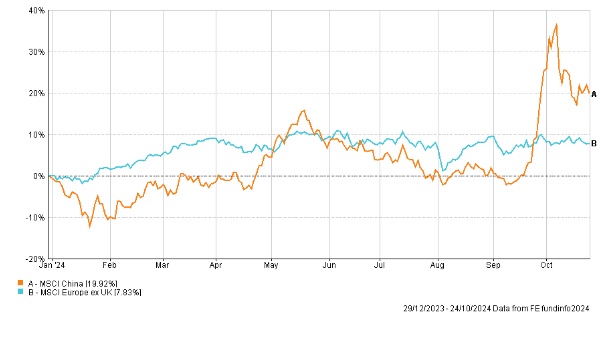

The European Central Bank (ECB) made another 25-basis point cut to interest rates to 3.25% at its most recent meeting. President, Christine Lagarde, expressed confidence that inflation is on track to sustainably hit the target level of 2.00%. The September reading was 1.70%. The ECB commenced cutting rates in June, with the October move the third of its kind this year.

After enjoying a meteoric rise at the end of September following the announcement of a multi-faceted stimulus package by authorities, the Chinese stock market indexes were more muted in October. Investors await more granular detail on the respective measures to boost growth within the Chinese economy. Despite the planned measures, structural problems remain in the economy, such as in the indebted property sector.