At the time of writing, the United States Presidential Election is a little over a week away and our attention turns to what impact this might have on investment markets.

The perhaps inevitable news at the start of October that Donald Trump had contracted Covid-19 did not provide a surge in sympathetic support he perhaps might have hoped for. Instead, Trump saw his poll numbers fall continually throughout October and they now point to a likely Biden victory.

Polls however, as we have learned in recent years, are not tremendous predictors. This combined with the quirks of the US electoral system means Trump can lose the popular vote, as he did in 2016 by 3 million votes, but win the electoral college and therefore secure a second term in office. With these two intricacies in mind, it is impossible to write off Trump and make a call on the election. What we can do though is hypothesise on what either result will mean for investment markets.

We hope you find this content useful and invite any questions you may have about how this could affect your financial plan, via:

t: 01228 210 137

e: [email protected]

Trump vs Biden

The short simple answer is that it is unlikely a clear victory for either nominee will have a major impact on the near-term movement of investment markets. In either outcome, little will change whilst the Covid fires are still being fought. Either victor will provide large stimulus to bolster the economy and attempt to negate the effects of unemployment, deflation, and the virus itself.

In the longer term the changes might be more pronounced, but it is not a case of one outcome being good for markets and one bad. We know what we can expect from Trump if he wins, bombastic presidency by Twitter and a continuation of his business favourable policies. Biden may look to reverse some of Trump’s corporation tax cuts, increase regulation, and attempt to enact environmental change that would hamper traditional energy companies, but he would spend money on healthcare and infrastructure which will boost the economy.

With these general policies it is unlikely a clear win for either candidate would be detrimental to investment markets. There is however a potential third outcome that could cause some turbulence in the coming months: a contested election with no clear winner. This is most likely to happen if the result is a narrow Biden win and Trump, having spent most of the year planting seeds of doubt over the integrity of postal voting, challenges the decision, potentially taking the outcome to the supreme court. If there is one thing markets do not like, and it is a continuing theme this year, it is uncertainty and in this outcome we would expect to see a rise in volatility until the result can be resolved.

So, what happens then?

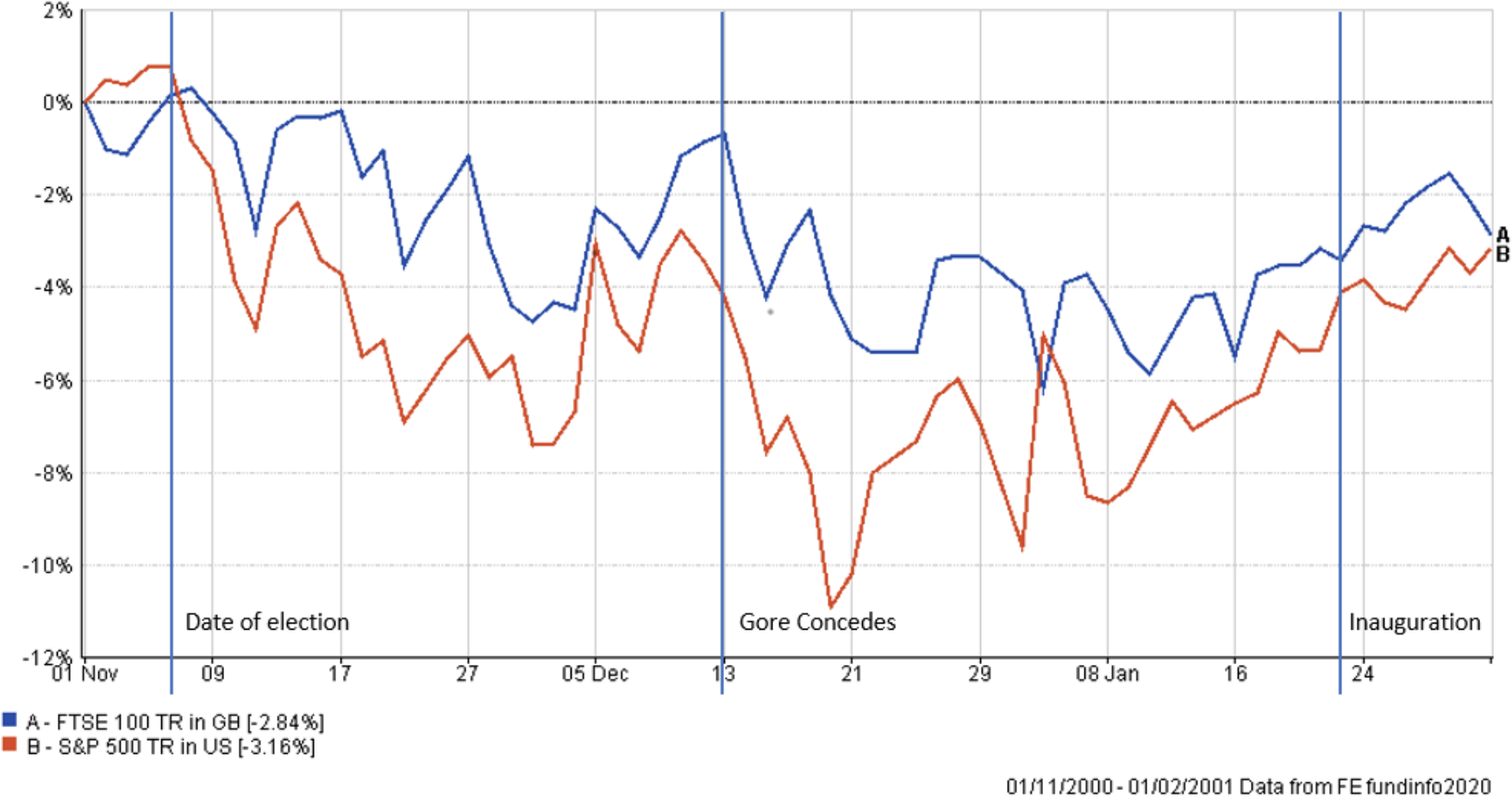

There is some precedence for this outcome in very recent memory and we can perhaps look to this for clues on what a contested result would mean for investment markets. The 2000 US election between George W. Bush and Al Gore saw an unclear initial result with the state of Florida voting in favour of Bush in such a small margin it required a recount by law. This led to Gore challenging the outcome but, after the supreme court ultimately ended motions for further recounts, Bush was officially declared the winner little over a month after the election.

Looking at how investment markets reacted to the contested result it appears, looking at the immediate months following the election, that markets reacted negatively to the news.

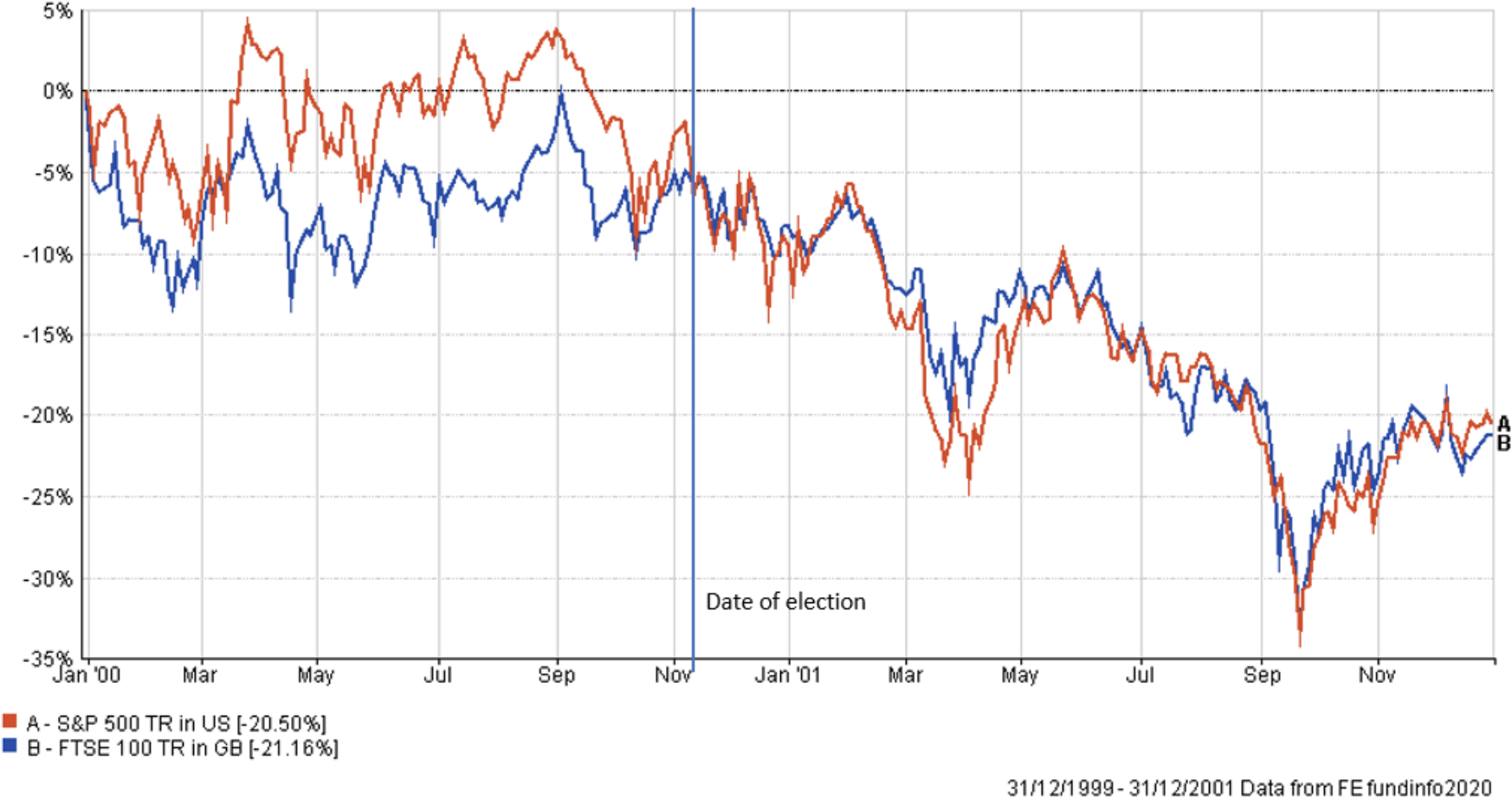

Unfortunately, this story might not give us the clues we want. Whilst current market conditions are volatile due to the ongoing global pandemic, US stock markets were routing in 2000 as the dot-com bubble had begun to burst in March of that year. If we look at a longer time period, we can see that the election outcome is barely noticeable, and markets followed their decline down as overvalued tech companies, particularly in the US, saw their values plummet.

What was ultimately driving the market then was negative sentiment resulting from the dot-com crash. Markets in 2020 have their own problems. But we are not stood looking into the abyss that investors were back then. Stimulus to boost the US economy in its fight against Covid-19 will come; neither candidate will instigate policies that will be detrimental to the recovery of the economy. If the election is contested it will introduce noise and volatility into investment markets. But when it quietens down, and the outcome is decided, markets will carry on as normal. We can expect volatility, but this itself is becoming part of the ‘new normal’ and the election at least takes up some headline space away from the doom and gloom of the current news cycle.

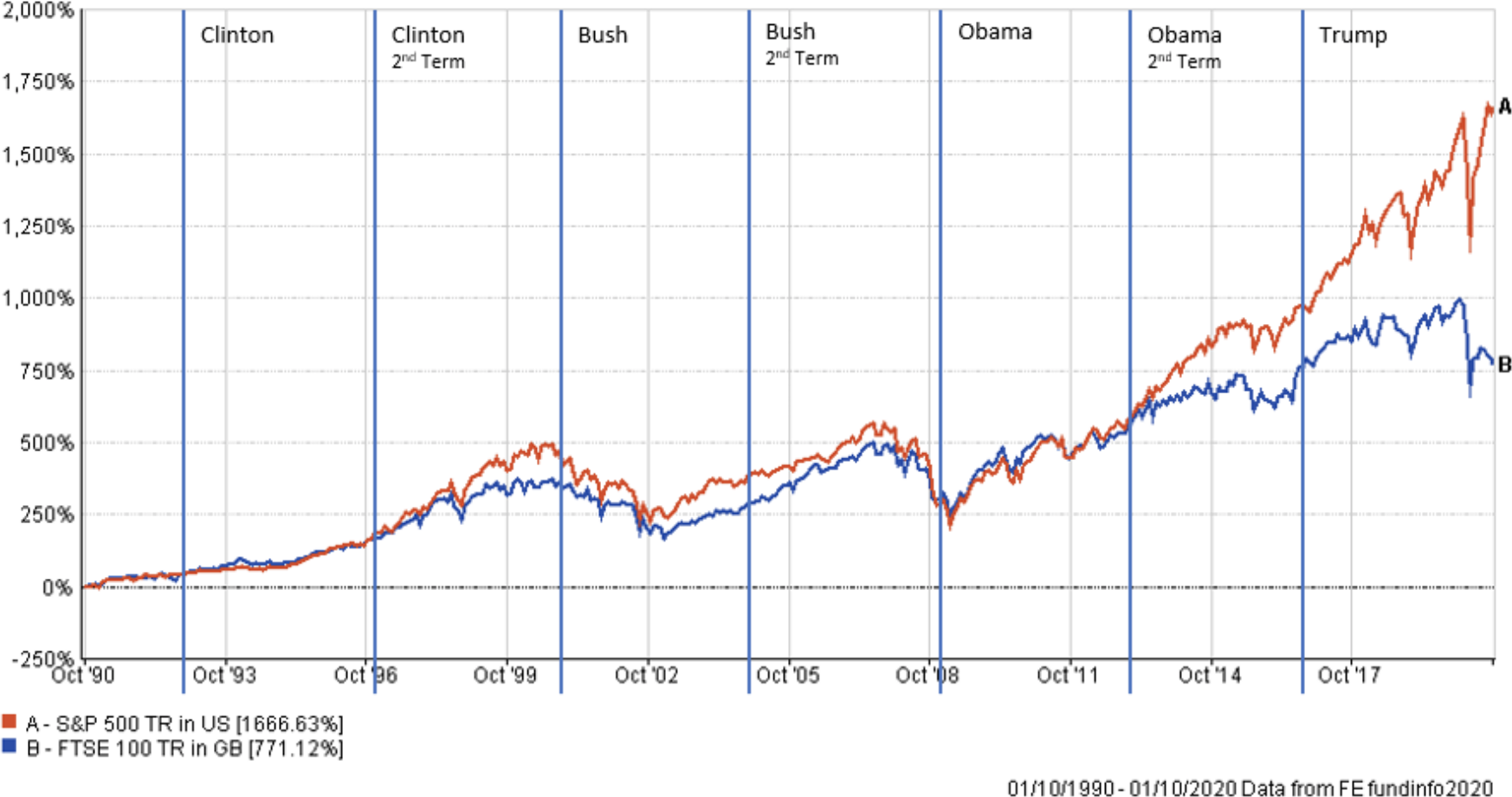

The election does not matter

Ultimately, the pantomime-esque build up and outcome of these elections are largely irrelevant to your investments in the long term and we do not expect the outcome of this election to be any different. The classic investment paradigm that we have been advising clients since the pandemic began rings true again in the context of this election, time IN the market not TIMING the market. Presidents, prime ministers, pandemics. They all come and go. But investing for the long term, and leaving your money invested throughout these events, has historically been the best strategy and we remind our clients of this fact.

If you would like to discuss anything in this update, please contact your Financial Planner here at Vesta Wealth in Cumbria, Teesside and across the North of England. Note that the information in this market update represents the views of the Investment Managers at Vesta Wealth Limited at the time of writing, which may change.

Reach us via:

t: 01228 210 137

e: [email protected]

This content is for information purposes only. It should not be taken as financial or investment advice. To receive personalised, regulated financial advice regarding your affairs please consult your Financial Planner here at Vesta Wealth in Cumbria, Teesside and across the North of England. Note that the value of investments and the income from them call fall as well as rise.