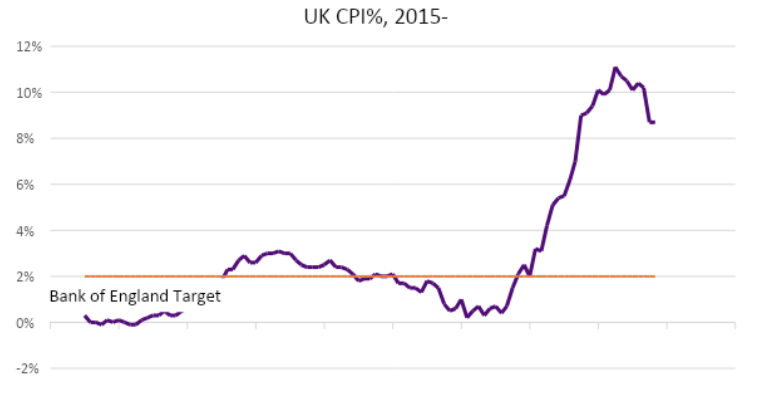

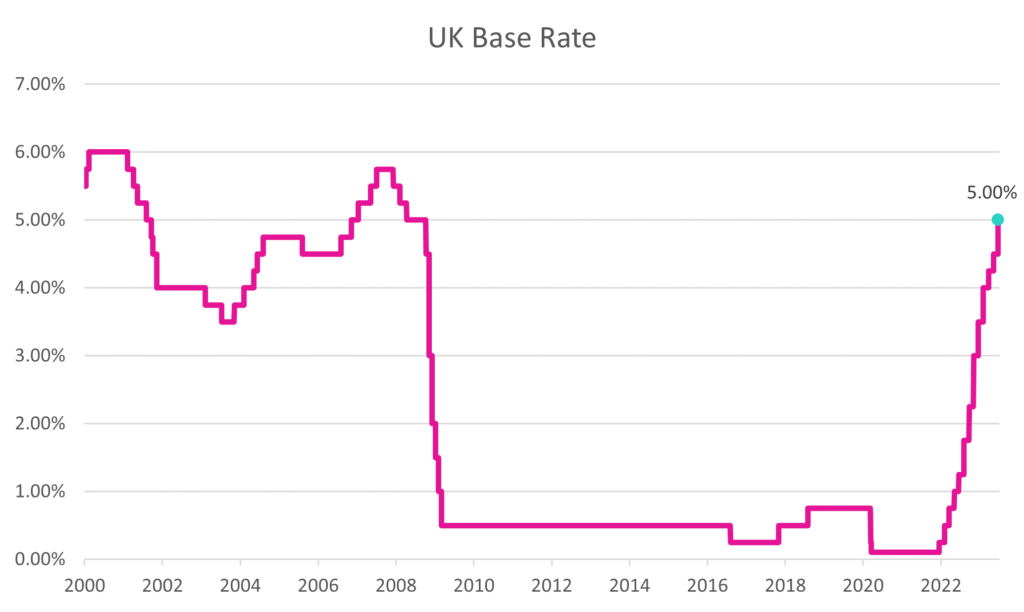

Inflation, and the response of Central Banks in attempting to control it, continues to be the biggest factor impacting investment markets. Stubbornly high inflation figures prompted The Bank of England to raise interest rates by 0.50% to 5% on the 22nd of June, double the previously expected 0.25% move. This followed the UK CPI reading for May of 8.70%, unchanged on the previous month, which was released the day prior to the rate announcement.

It had been hoped that inflation would continue to trend downwards as this might suggest central banks were winning in the fight against inflation. Consensus forecasts widely expected this to be the case with most estimates expecting a reading of 8.40%. However, with headline inflation remaining unchanged from the previous month it suggested the need for further, more drastic, central bank policy responses.

While the headline figure remaining unchanged was concerning for markets, the more unsettling piece of news was the recorded level of ‘core’ inflation. This ‘core’ measure excludes the more volatile components such as food and energy to try and give a more accurate picture of the level of inflation within the economy. The worrying fact for investment markets, and the factor that prompted the surprise 0.50% rise in interest rates by the Bank of England, was that this measure increased to 7.10%, a 31 year high.

The rise in core inflation is consistent with growth in regular earnings of 7.20% in the three months to April. Collectively, these evidence the extent to which inflation is entrenched into the system, a key concern for the Bank of England. Whilst it is tempting to identify wage growth as a key protagonist, it is equally short-sighted to not recognise the desire of employees to maintain their living standards, particularly amid tight labour market conditions. With the near 10% increase in the Living Wage in April telegraphed well in advance, it cannot be considered a surprise that workers outside this band would also seek meaningful raises to maintain their pay premium.

The rise in core inflation is consistent with growth in regular earnings of 7.20% in the three months to April. Collectively, these evidence the extent to which inflation is entrenched into the system, a key concern for the Bank of England. Whilst it is tempting to identify wage growth as a key protagonist, it is equally short-sighted to not recognise the desire of employees to maintain their living standards, particularly amid tight labour market conditions. With the near 10% increase in the Living Wage in April telegraphed well in advance, it cannot be considered a surprise that workers outside this band would also seek meaningful raises to maintain their pay premium.

Economic Impact

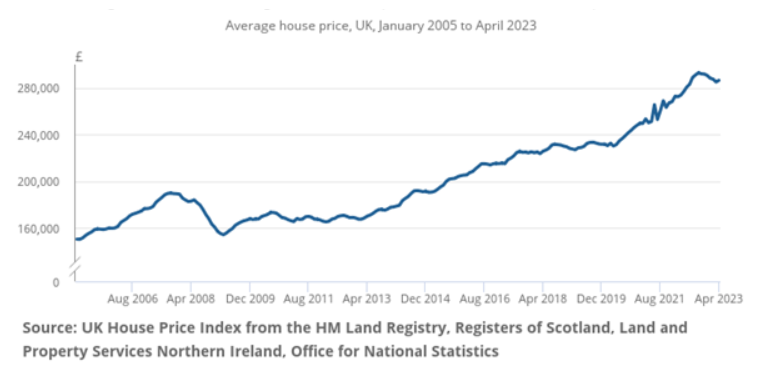

With interest rates poised to move higher, it appears likely that unemployment levels, which are at near historical lows, will drift higher. The housing market is another key area to watch, as households adjust to higher financing costs. At the risk of becoming too gloomy, it must be remembered that banks have for some years incorporated stress testing into the mortgage application process, requiring borrowers to evidence their ability to make repayments at higher interest rates. Current conditions will be a meaningful test of this process.

In addition, UK banks are currently well capitalised, and there is a willingness to cooperate with the government to provide solutions for households under pressure. However, there are of course limits to any goodwill. House prices are expected to experience some pressure due to rising mortgage costs, although, the market remains underpinned by general shortages and high employment levels.

In a boost for the economy, the UK consumer has not given up on spending. There is certainly evidence of more judicious spending, as evidenced by the growth in the sales of ‘value’ ranges at supermarkets; however recent updates have suggested consumption remains high. Bellwether retailer, Next, recently made an unscheduled trading update, raising guidance, as consumers upgraded their wardrobes amid the fine weather. Similarly, the sunny skies have provided a welcome boost to the pub companies. Furthermore, the desire to travel, post the covid pandemic, has translated into healthy trade for hoteliers and holiday companies.

The Global Position

Inflationary pressures and tighter monetary conditions are not unique to the UK, although, divergences are starting to emerge. In the US, the CPI reading for May, fell to 4%. Like in the UK however, enthusiasm was slightly tempered by a rise in the core rate to 5.30%. Nevertheless, the Federal Reserve took the opportunity to pause their cycle of interest rates, while issuing guidance to expect further rises later this year in their efforts to restore inflation to a more desirable level.

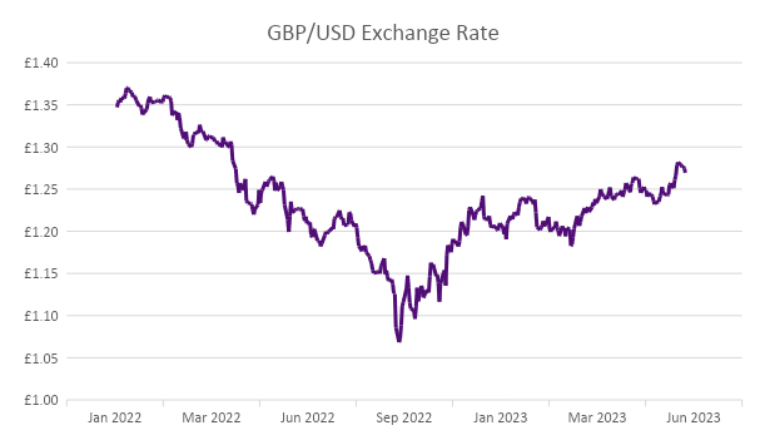

Meanwhile, the European Central Bank (ECB) raised rates by 0.25%, also guiding for further hikes in the coming months. Circumstances in the Eurozone are cloudy, with large differences in the respective inflation rates of member states. The relatively hawkish stance of the Bank of England has translated into the sterling strength, with the £1/$ exchange rate recently crossing the 1.28 level. A marked position of strength in deep contrast to the talk of parity in the days following the disastrous ‘mini-budget’ last year.

Over in Asia, Japanese equities have enjoyed a robust year to date, as investors warm to corporate governance improvements and the associated sharper focus on the delivery of shareholder value. Meanwhile, in China, equity market momentum has stalled, with the reopening bounce proving to be less pronounced than hoped. The authorities have responded by loosening monetary conditions. Moves towards a thawing of relations with the US, as evidenced by the recent visit of Secretary of State, Antony Blinken, remain at a sensitive and early state.

With yields moving higher, as central banks battle to tame inflation, the bond versus equity equation is more finely balanced, underlying the need for well-constructed diversification within investment portfolios.