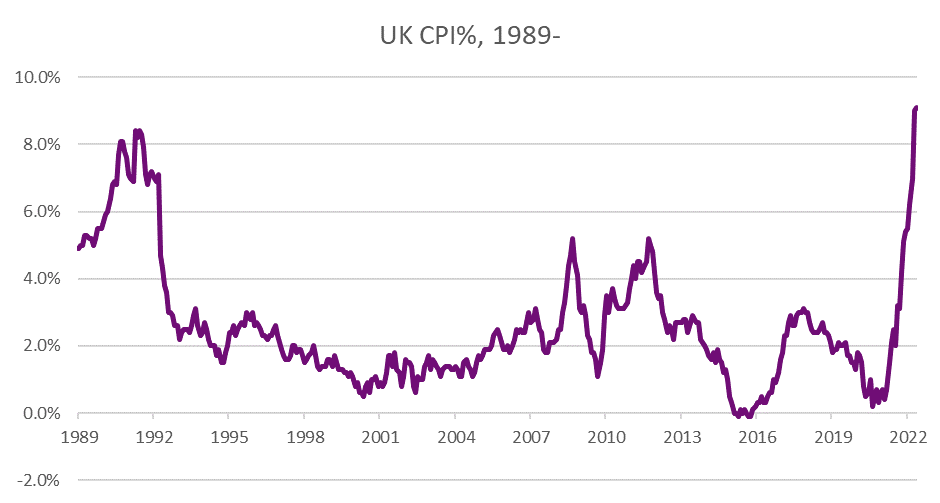

June has been a very turbulent month for financial markets, continuing a difficult start to the year. Inflation concerns have been paramount as investors have considered the impact it will have on economies and the businesses within them. May 2022 inflation prints for the UK and US added to these concerns as inflation hit 9.10% and 8.60% respectively, the former being a 40-year high.

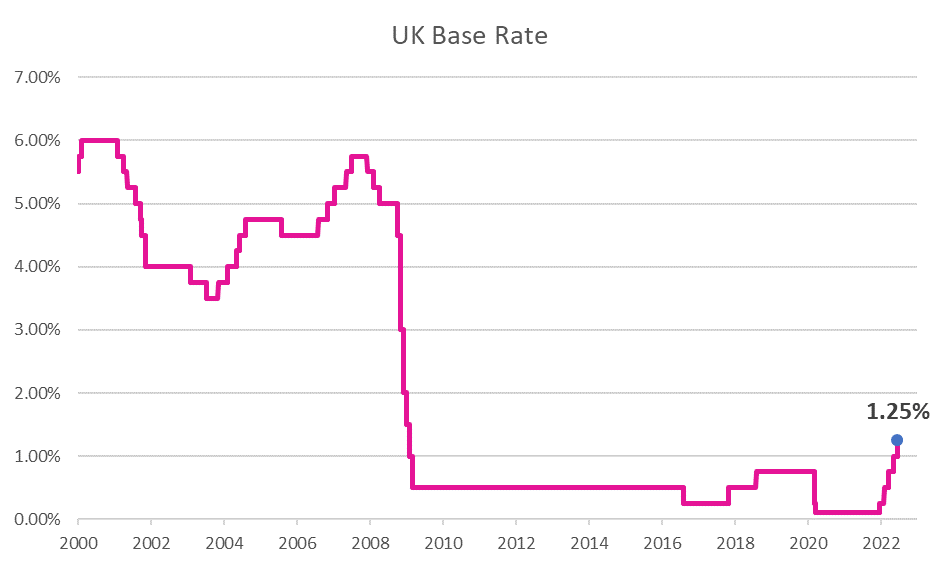

Finding themselves behind the curve, central bankers are scrambling in their attempts not just to restore price stability, but also their credibility. The US Federal Reserve raised rates by 0.75% at the June meeting to a target range of 1.50% to 1.75%. Chairman Jerome Powell has stated that rate rises will continue, as “inflation is running too hot”. At their respective June meeting, the Bank of England’s Monetary Policy Committee raised rates by a more conservative 0.25% to 1.25%, while also signalling further raises ahead.

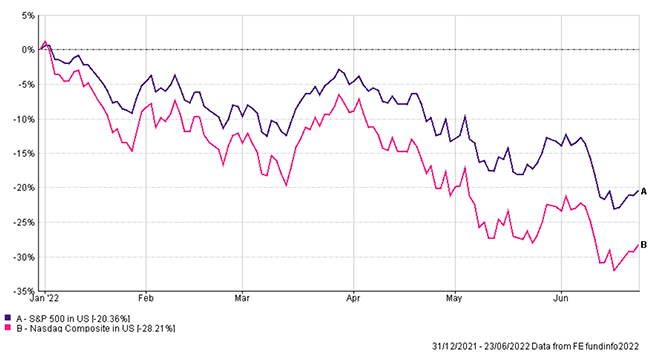

Surging inflation, and monetary tightening, have placed both equities and fixed income investments under pressure, undermining the elementary forms of portfolio diversification. Benchmark US indices, the S&P 500, and NASDAQ Composite, have both fallen into bear market territory. This is largely a result of investors applying higher discount rates to their financial models, in addition to factoring in recessionary risks as consumer disposable incomes are eroded by pricing pressure.

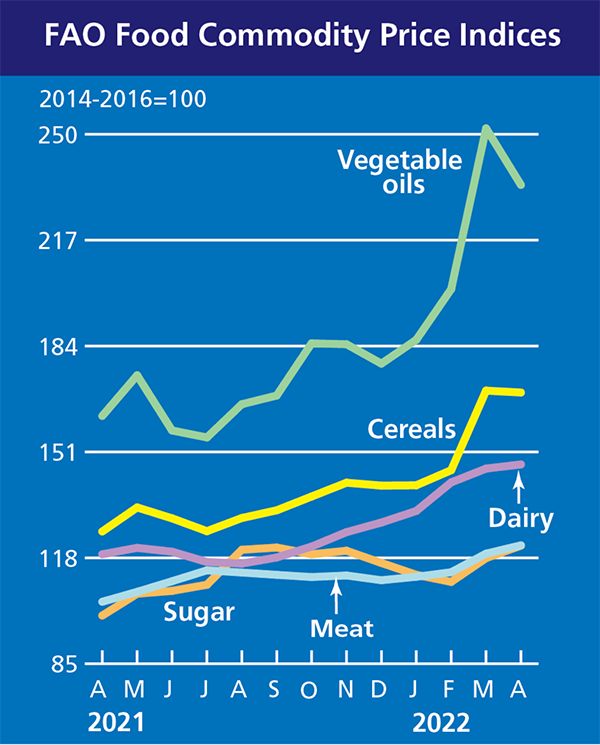

This underlines the fine balancing act that central bankers must perform. In attempting to cool economic activity to restore price stability, they risk inducing recessionary conditions. Furthermore, many contributory factors behind the surge in inflation are out of the control of monetary authorities. Examples being energy and food prices. Agricultural commodities such as wheat, corn, sugar, oil, and coffee have seen strong price momentum this year. Rising food and energy costs have prompted consumers to make uncomfortable trade offs and are contributory factors behind industrial action, as workers see wages lag inflation.

Source: UN Food and Agriculture Organization (FAO)

Inflationary pressures, resulting from disruption caused by the pandemic have been further aggravated by the war in Ukraine and China’s tough stance on the virus. Whilst the west has instituted unprecedented sanctions on the Russian economy, and number of its wealthy individuals, there has also been an economic backdraft.

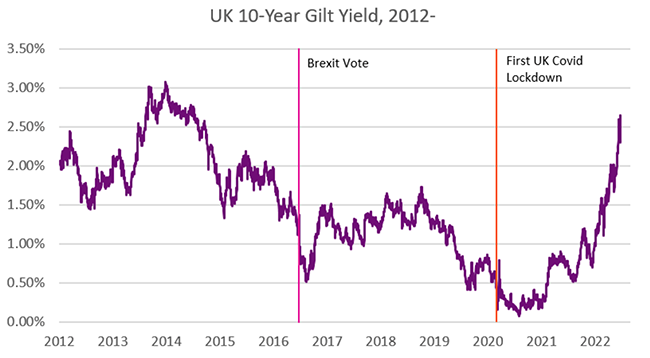

As referenced above, fixed income investments, often seen as natural diversifier to equites, have not been immune to the prevailing challenging conditions. Yields on developed market bonds have reached multi-year highs, as the era of ever cheaper money draws to a close. While this may feel like an uncomfortable adjustment, it is also a necessary one.

As money became ever cheaper, so the prices of higher risk investments soared to new and unsustainable highs. With changing financial conditions, investors have been forced to re-evaluate these valuations. In this regard, investments ranging from speculative growth stocks, to cryptocurrencies, have seen sharp price declines. Hitherto considered one-way bets, many risk assets have suffered an unpleasant acquaintance with reality.

Stay invested

It is of course natural to feel unsettled amid volatility. But it is also important to remember that financial markets are forward-looking mechanisms. A function of investors’ forward-looking assumptions. While it is possible that conditions could become more challenging, attempting to time market movements is a vexing affair. An investor may be fortunate enough in making a fortuitous disinvestment; but could equally be slow to spot a recovery.

Even in tough times, there will be companies which meet, and in some cases, exceed, their earnings expectations. When market sentiment is fragile, such resilience is often poorly rewarded. The shares of good companies become oversold. This creates long-term opportunities, for those with the requisite patience.

There are also structural changes, which remain undiminished. The move to net-zero economies and shorter, more secure, supply chains being two such examples. These are more durable than the exuberance associated with the lockdown economy when investors extrapolated artificially induced trends. There is a Darwinian element to financial markets, with the strongest and most innovative entities emerging from challenging conditions.

In addition, not all economies are the same. As western economies battle inflation and have little scope to apply stimulus to boost growth, there are Asian economies, most notably China, that are not experiencing the same pricing pressures. They also have the potential to lower interest rates to boost the economy following the cautious relaxation of covid restrictions. We will continue to balance defending capital with seeking to identify long-term profitable opportunities for investors.

Invitation

If you would like to discuss your financial plan and investment strategy, then we would love to hear from you. Get in touch with your Financial Planner here at Vesta Wealth in Cumbria, Teesside and across the North of England.

Reach us via:

t: 01228 210 137

e: [email protected]

This content is for information purposes only. It should not be taken as financial or investment advice. To receive personalised, regulated financial advice regarding your affairs please consult your Financial Planner here at Vesta Wealth in Cumbria, Teesside and across the North of England.