Month to month, Inflation continues to dominate investment market headlines. In July though it was for more positive reasons as UK inflation data for June came in lower than expectations. This provided a boost to investor sentiment on the hope that central banks may finally be getting the upper hand in the fight against rising prices.

Please contact us for more information or to speak with a financial adviser:

t: 01228 210 137

e: [email protected]

Falling Inflation

UK Consumer Price inflation (CPI) in June was recorded at 7.90%. This was a marked fall from the measure in May of 8.70%. High inflation has been a cause for concern for investors for nearly two years and this fall provided notable relief to financial markets as it appears to confirm a downward trend. There was further relief as this figure was lower than consensus forecasts suggesting inflation may be falling faster than analysts have predicted. Together these provide UK investors hope that the tide may be turning in the war with inflation.

The slowdown in the rate of inflation was led by falling fuel prices. At the same time, food price increases, the source of much inflationary pressure, have begun to moderate.

Market Reaction

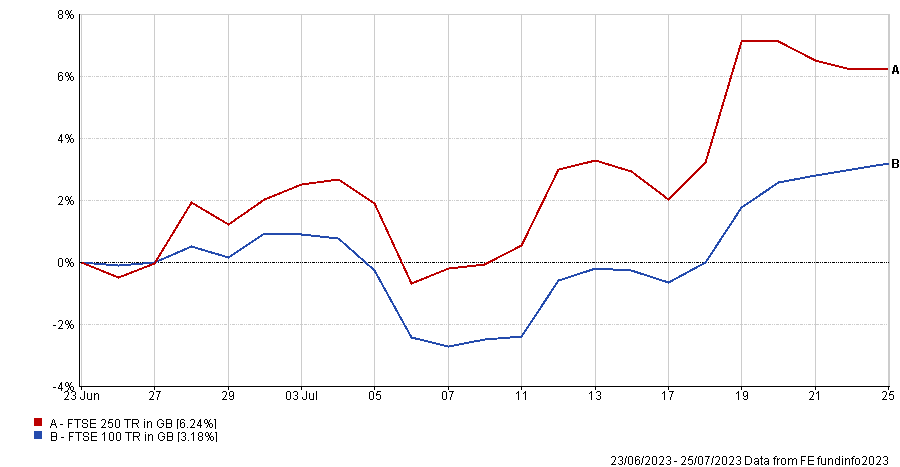

In response to falling inflation, financial markets moved to price in a slower pace of interest rate rises from the Bank of England. In addition to the slower pace of rises, markets are also now pricing in a lower peak in the base rate. Together, these provided a boost to UK stock market performance.

Despite the positive inflation figure in June however, the headline rate of inflation is still over three times above the Bank of England’s target rate of 2%. As a result, there is still little room for complacency and a surprise higher inflation reading in the months to come could inspire the central bank to take further drastic action as it tries to combat rising prices.

That said, the trend is encouraging. With falling energy prices, and the resulting fall in the energy price guarantee, lower household energy bills will feed into future readings. There was also more positive news in the measure of Core CPI inflation which was recorded at 6.90% in June, versus 7.10% in May. This reading excludes the more volatile constituents such as energy, food, alcohol, and tobacco.

Falling inflation was not only a UK story. In the US, CPI inflation for June fell to 3%, with the core reading at 4.80%. With global inflation largely trending downwards, this has led to hopes that central bankers can orchestrate a soft landing, taming inflation, while avoiding a recession. Historically, this has been a difficult balance to achieve.

Avoiding Recession

In the UK, base rates have moved from 0.10%, to 5.00% in June 2023, following 13 consecutive increases beginning in December 2021. Economic theory assumes rising interest rates reduces consumption as borrowing becomes more expensive and saving becomes more attractive. Economists debate the duration of the lag effects of interest rate increases, however, after 13 upwards moves, it is reasonable to assume that the economy has yet to feel the full impact.

So far, corporate news flow has in aggregate been positive, with consumers showing a continued appetite for experience led expenditure. Employment levels also remain high, although there are early signs that vacancy levels are falling. Furthermore, while inflationary pressures are showing signs of easing, higher mortgage costs, along with reduced availability of credit, will present a headwind. It is these economic pressures which are a cause for recessionary concern.

The Flash UK Purchasing Managers’ Index (PMI) for July was recorded at 50.70, down from 52.80, a month earlier. This is a widely followed, forward looking indicator for the private sector, with readings above 50, implying expansion. The soft-landing argument therefore remains finely balanced, with the US economy appearing as the strongest candidate for this outcome. The US Federal Reserve, European Central Bank, and Bank of Japan, are all set for interest rate decisions during the week commencing 24th July 2023. This represents an important week for financial markets, with accompanying rhetoric arguably more important than the decisions set to be announced. The Bank of England is scheduled to meet in early August.

Stock Market Performance

While still announcing growth rates far in excess of the developed world at 6.30% in the April to June months, the Chinese economy has fallen short of expectations in its post-Covid-19 recovery. This relatively ‘disappointing’ performance has prompted calls for further economic stimulus. Hong Kong and mainland China equity indices have delivered underwhelming performance in the year to date as a result. This is in stark contrast to Japan, where improved corporate governance, and the sharper focus on shareholder value, has driven investor interest.

The FTSE 100 has thus far failed to replicate the relative outperformance booked in 2022, trailing both European and US indices. The US mega-cap tech stocks have powered both the S&P 500, and NASDAQ Composite Indices to impressive year-to-date gains. Meanwhile, reduced inflationary pressures have provided relief to the fixed income markets. Homeowners, and indeed the government, will be hoping such moves are sustainable and translate into more favourable mortgage pricing.

Invitation

If you would like to discuss your financial plan and retirement strategy, then we would love to hear from you. Get in touch with your Financial Planner here at Vesta Wealth in Cumbria, Teesside and across the North of England.

Reach us via:

t: 01228 210 137

e: [email protected]

This content is for information purposes only. It should not be taken as financial or investment advice. To receive personalised, regulated financial advice regarding your affairs please consult your Financial Planner here at Vesta Wealth in Cumbria, Teesside and across the North of England.