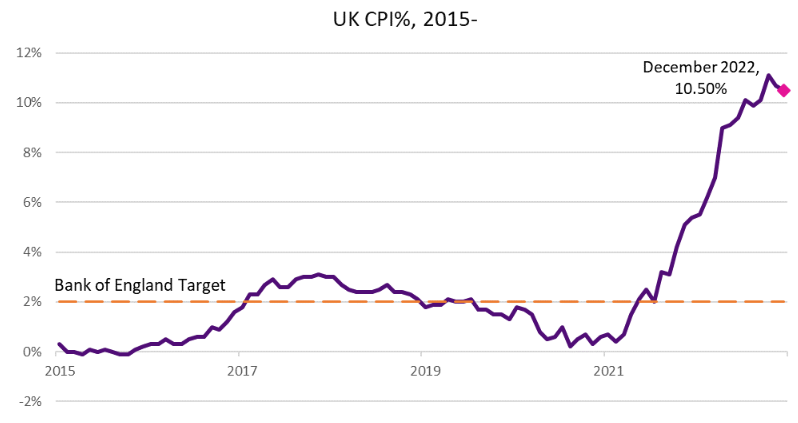

Financial markets have started the new year in a buoyant fashion, continuing their momentum built up towards the close of 2022. Investors have taken encouragement from further evidence that inflationary pressures might have peaked. The UK inflation reading for December 2022 was 10.50%, falling modestly from 10.70% in November 2022. The reading had previously reached 11.10% in October, a 41-year high. In the US, the decline is more pronounced, with the inflation rate for December 2022 reaching 6.50%, down from 7.10% in November, and a peak of 9.10% in June 2022. Financial markets have responded by pricing in less hawkish action by central bankers, which has boosted both equities and bonds.

In the UK, there are concerns however that inflation is proving to be stickier than in other developed economies. The noted moderation in inflationary pressures in December was largely owing to lower fuel prices, which many motorists will have observed at the pumps. But of particular note, food price inflation for the same month reached almost 17%. This is a challenge for households, most pertinently those living from lower levels of income.

With budgets already under strain in low-income households, inflation on core goods will continue to add pressure in the ‘cost of living crisis’. In addition, industrial disputes are still running, and wage inflation is at levels far above that consistent with the Bank of England’s Consumer Price Index target of 2%. Workers want wages to keep pace with inflation, however, some economists fear locking in large wage rises could add to inflationary pressures in a never-ending cycle.

A stronger economy than feared?

Elsewhere, there are encouraging signs. Natural gas prices have plunged, as winter temperatures across Europe have been relatively mild, and efforts to secure supplies were successful. Owing to the price cap formula, households will not see an immediate benefit, however, on current projections, energy bills could fall significantly later in the year. In addition, lower energy prices will require less government subsidies under the current scheme to shield households and businesses from price spikes. This should translate to lower, but still high, public borrowing requirements.

The UK economy was estimated to have grown by 0.10% in November, exceeding forecasts. Economists still forecast a recession, as the cost-of-living crisis and higher mortgage servicing costs eat into household budgets. The latter is most pertinent for those households moving off fixed-rate mortgages started during the lockdown periods when interest rates were at their lowest. Again, there has been some relief, as bond yields have fallen substantially from the immediate aftermath of the ill-fated ‘mini budget’ in the autumn of 2022. This is positive news for households as it means the rise in interest rates they will face on their mortgage is likely to be lower.

Businesses holding up

Despite fears over the health of the economy, reports from companies have painted a greater picture of strength. In general, trading updates from well-managed businesses have met, or exceeded, previously downgraded forecasts. Sales or revenues, helped by inflation, have held up. However, rising costs have challenged profitability which is a cause for question marks for investors.

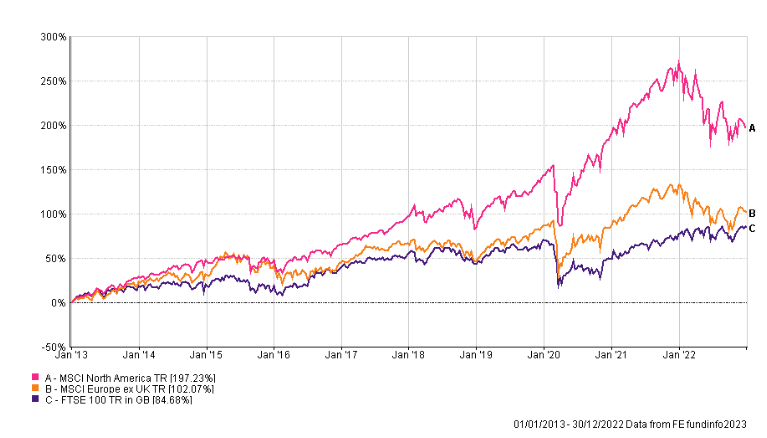

With stronger company performance this has translated into largely positive returns from equity indexes. The FTSE 100 index has regularly flirted with all-time highs, and the more economically sensitive sectors of the FTSE 250 have rallied. The momentum of the FTSE 100 must be considered in the context of the longer-term performance of the index, which has seen it lag international peers over the last decade.

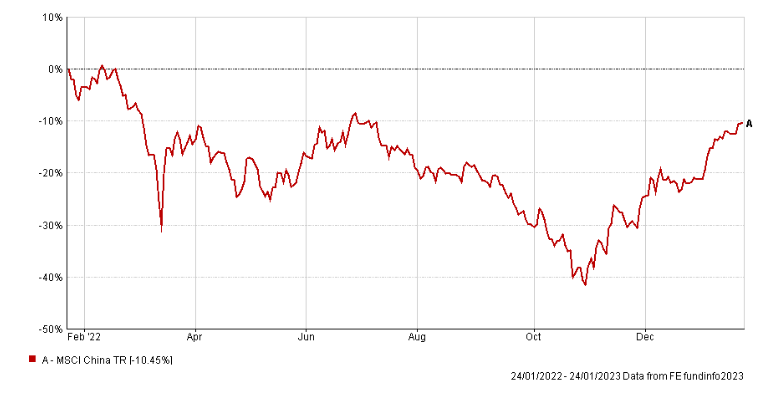

Over in Asia, the cessation of China’s uncompromising zero-covid strategy has awakened investor interest and seen shares in the region perform strongly. Hopes were further cultivated by business-friendly comments made by Vice Premier, Liu He, at the World Economic Forum in Davos. Both identify the sharp need to stimulate economic growth in China, after a prolonged period of disruption relating to covid related lockdowns. Such a sharp gyration in policy also comes with risks, as the Lunar New Year celebrations sees the mass movement of people which is likely to prompt a sharp rise in covid infection; and likely mortalities. Furthermore, such as sharp move in reopening could also create new inflationary pressures in commodity and energy prices if demand surges as a result.

Aside from the obvious human tragedy, the war in Ukraine is an ongoing risk to the global economy, as both sides position for a spring offensive to turn the tide of the conflict. The impending introduction of modern, sophisticated, tanks from western allies, while likely to be an influential factor, could also be considered a serious escalation from the Russian side. The difficult negotiations between western allies covering the provisions of tanks, reflected the delicacy of the situation. It is a fine balance between providing support and being seen as taking an active part in the conflict.

With the investment landscape finely poised, selectively taking profits and recycling capital will allow investors to navigate both emerging risks and opportunities.

Invitation

If you would like to discuss your financial plan and retirement strategy, then we would love to hear from you. Get in touch with your Financial Planner here at Vesta Wealth in Cumbria, Teesside and across the North of England.

Reach us via:

t: 01228 210 137

e: [email protected]

This content is for information purposes only. It should not be taken as financial or investment advice. To receive personalised, regulated financial advice regarding your affairs please consult your Financial Planner here at Vesta Wealth in Cumbria, Teesside and across the North of England.