Inflation has been the biggest factor driving market sentiment in the last twelve months. Recent market movements suggest there is little sign of this changing as we move towards the end of 2022. But as the UK has been challenged by freezing cold temperatures, there are also signs that inflation may be starting to cool.

With central banks scrambling to raise interest rates in an attempt to contain spiralling inflation throughout the year, investors have been forced to reappraise what had been established as the norm during the last decade. Having spent the years following the 2008 global financial crisis in a supportive low-interest rate, low-inflation environment; investors have had to reappraise their positions in a changing situation now with decades high inflation, and rising interest rates. This provided the conditions for a volatile 2022 even without additional factors such as the war in Ukraine, and ongoing disruption from covid hangovers in supply chains.

Inflation peaked?

There are early signs however that inflation is starting to slow. Indeed, some market commentators suggest inflation has already peaked. As a result, investors are beginning to reappraise the outlook for investment markets and there has been a sense of greater optimism on the hope that central banks may be able to pause, or at least slow down, their efforts to contain inflation. Markets view this as a positive as higher interest rates raise the cost of capital and hinder economic activity. With rates potentially not rising at such a fast pace, or even starting to be lowered, then this provides better economic conditions than previously forecast offering a boost to the market outlook in 2023.

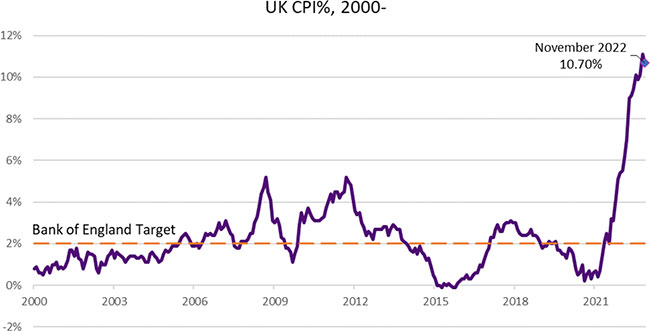

In the UK, CPI inflation data for November suggested inflation had fallen slightly from 11.1% to 10.7%. The ONS on releasing the inflation figures suggested the small decline was a result of falling petrol and diesel prices on the back of falling crude oil prices. While this slight fall in the rate of inflation is a good sign for the UK economy, prices are still rising at levels not seen for 40 years.

It is a similar story in the Eurozone and in the US. Inflation appears to be starting to fall but it remains at elevated levels. As a result, the rhetoric from central banks has been clear that while the initial battle might have been won in combatting rising prices, the war is far from over. As a result, despite investor optimism, central banks still expect to raise interest rates to attempt to bring inflation down to target. This was seen in December when both the US Federal Reserve, the Bank of England, and the European Central Bank all raised their respective base rates by 0.50%.

The inflation equation

The other side of the coin in the inflation debate, and the impact of rising interest rates, is how resilient economies will be in the face of it. Households will continue to come under increasing pressure in 2023 from price rises. Food price inflation remains acute, higher taxes are being introduced, government support on energy costs is planned to be reduced, and mortgage costs for millions are expected to rise severely. Amongst other factors, these collectively mean that people will have less disposable income. With less money to spend it naturally decreases demand in the economy.

The positive for central banks in their inflation equation is that with demand falling, it will decrease upwards price pressures. However, the cost of this, and ultimately the cost of central banks reducing inflation back to target, is a recession. Markets have been expecting, and economists are widely in agreement, that a recession will happen; the Bank of England thinks the UK is already in recession. It is now the question of how deep any recession might be.

There is also the question of how central banks may respond to a downturn. Whether they may feel they can support an ailing economy if inflation is falling slowly. Or stay the course, potentially inflicting greater pain, to achieve their inflation targets. With upwards wage pressures and low unemployment likely to mean inflation is stickier than previously forecast, and likely to remain at elevated levels throughout 2023, central banks may feel their hands are tied.

Chinese reopening

One factor which may help to support the global economy if it suffers a slowdown in demand is the ‘reopening’ of China. With less effective vaccinations, and without comprehensive coverage, China has continued to battle covid with lockdowns. This has affected economic growth and created uncertainty within markets. Following recent protests, which the Chinese government claim have had no bearing on any decisions, covid restrictions are to be eased in the country. This has had a major boost to the region’s equity markets and it is hoped that easing supply chains and greater growth will ease inflationary pressures and boost the outlook for the global economy.

Invitation

If you would like to discuss your financial plan and investment strategy, then we would love to hear from you. Get in touch with your Financial Planner here at Vesta Wealth in Cumbria, Teesside and across the North of England.

Reach us via:

t: 01228 210 137

e: [email protected]

This content is for information purposes only. It should not be taken as financial or investment advice. To receive personalised, regulated financial advice regarding your affairs please consult your Financial Planner here at Vesta Wealth in Cumbria, Teesside and across the North of England.