This content is for information purposes only. It should not be taken as financial or investment advice. To receive personalised, regulated financial advice regarding your affairs please consult your financial adviser here at Vesta Wealth in Cumbria, Teesside and across the North of England.

When it comes to long term investing, at Vesta Wealth we employ a mixture of strategic and tactical asset allocation. What does this mean, what are the differences and why is this important? In this article, we consider these points and more.

We hope you find this content useful and invite any questions you may have about how this could affect your own investments via:

t: 01228 210 137

e: [email protected]

Long term investing

Firstly, it’s important to say that we are talking about long term investing here, for periods of at least 5 years. Over this time, it is more likely that the benefits of investing will be achieved, versus not investing.

Strategic Asset Allocation

In simple terms, this is putting your savings into a number of different asset classes, in the right proportions, in a manner which will stand the test of time (assuming no change in your requirements or circumstances).

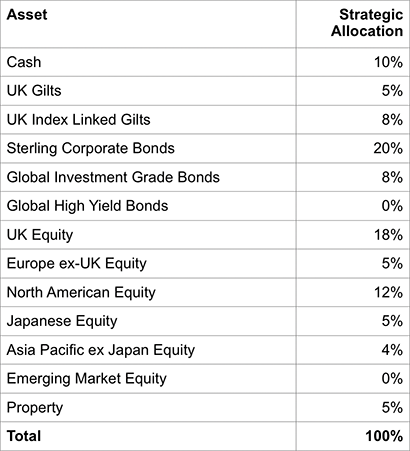

To illustrate, for investors with risk profile 4, our strategic asset allocation might look something like this:

Strategic asset allocation aims to deliver a very diversified portfolio, which allows you to gain from long term investment returns and spreads and lowers risk to a level which matches that agreed with your financial adviser.

Although it is long term in nature, it is regularly reviewed, and any changes tend to be made more gradual, depending on data which feeds into the creation of the strategic asset allocation model.

In various studies, strategic asset allocation has been shown to be the single most important determinant of overall long-term portfolio performance.

Tactical Asset Allocation

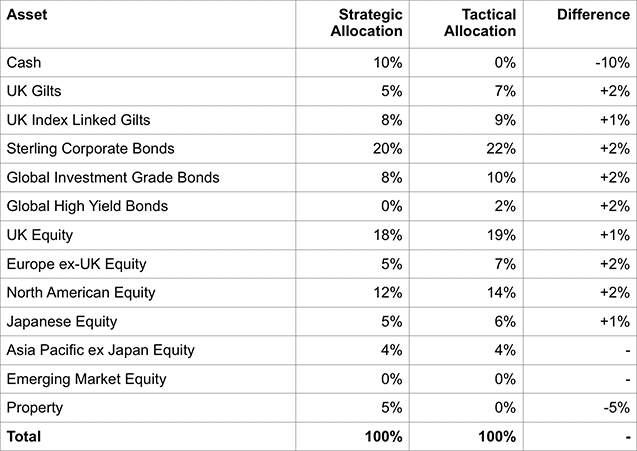

Tactical asset allocation is more concerned with shorter-term decisions, using the investment manager’s skills to assess whether refinements or changes should be made to the strategic allocation.

Whilst in theory the investment manager could make changes daily, this tends to be done monthly or quarterly, or at any time we see events unfolding which might create short to medium term opportunities or threats.

It is important not to over employ the use tactical decisions, which in some circumstances could lead to more volatility in performance or deviation from the risk profile agreed with your financial adviser.

As an example, the tactical asset allocation may look something like this:

Although tactical asset allocation is a lesser determinant of long-term performance, it is nonetheless an important aspect of where value can be added, as well as having a greater impact on short to medium term performance.

How Vesta manages your investments

We believe in keeping you up to date with important and relevant information, as well as new developments.

Our new passive model portfolios use strategic asset allocation and tactical asset allocation, we believe in a manner which will enhance your portfolio performance, whilst keeping costs low.

Invitation

To discuss your investments, get in touch with your financial adviser here at Vesta Wealth in Cumbria, Teesside and across the North of England.

Reach us via:

t: 01228 210 137

e: [email protected]