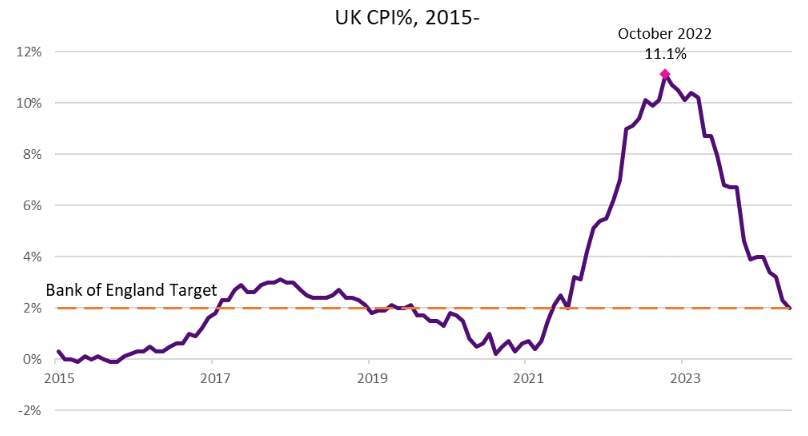

In the midst of a General Election campaign, UK inflation readings provided a source of optimism. The headline Consumer Prices Index (CPI) for May 2024 fell to the target rate of 2.00%, down from 2.30% in April. The headline CPI inflation reading has remained above the Bank of England’s (BoE) target rate since 2021, and hit an uncomfortable high of 11.10% in October 2022.

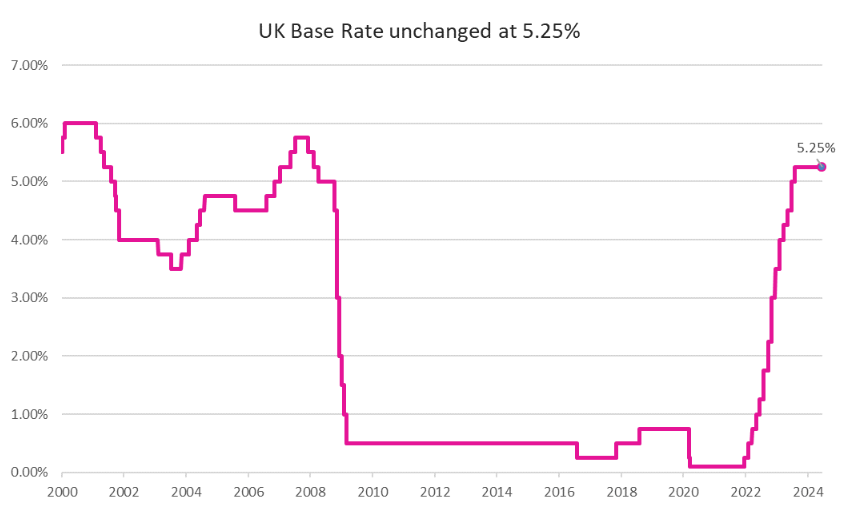

With inflation returning to target, there was some speculation the BoE may have cut interest rates. Nevertheless, the BoE exercised caution and held interest rates at 5.25%. This was the seventh consecutive ‘hold’, keeping them at a 16-year high.

The Committee voted 7-2 to hold rates, with the overall decision described as finely balanced. The two dissenters voted for a cut. Governor, Andrew Bailey, who voted to hold, stressed the need to be sure that inflation will remain low before cuts are made. Financial markets responded by increasing the probability of a 0.25% cut in August, sending bond yields lower and providing a boost to fixed income investors.

Services inflation remains elevated

Exercising an element of caution does not appear to be an unreasonable stance for the BoE. CPI services inflation remains notably elevated at 5.90%, despite a small decline on the prior month’s reading of 6.00%. This stands in stark contrast to CPI goods inflation, which recorded deflation (falling prices) of 1.30%. The UK economy, like many developed market peers, is strongly orientated to services and inflation in the sector cannot be easily dismissed.

When measured as a whole, the largest downward contribution for prices came from food. The normalisation of grocery price inflation has provided much welcomed relief to households across the country. Wage growth remains above general inflation, which is typically a healthy sign for consumption.

Data from the Office for National Statistics suggested that retail sales increased by 2.90% in May. A strong recovery from the 1.80% decline recorded in April, which was largely attributed to wet weather. The May figure was boosted by clothing sales with some commentators suggesting a stimulus from fans of US singer Taylor Swift attiring themselves ahead of her Eras tour. Fortunes for June and early July could be similarly open to weather and, with Scotland failing to make it out of the group stage, the trajectory of England’s performances at Euro 2024.

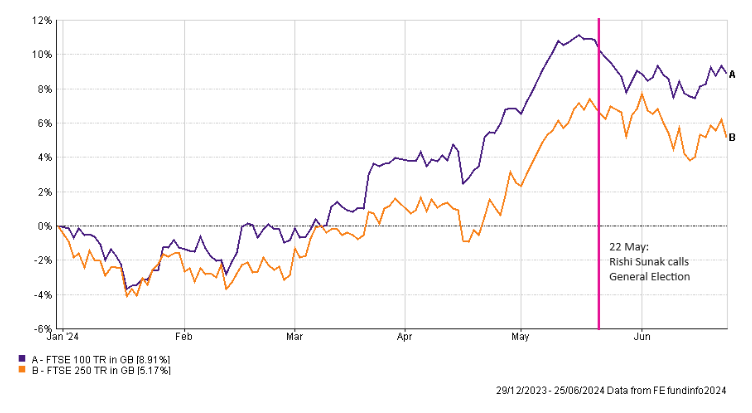

The election and the markets

Despite the ongoing uncertainty of an election campaign, the UK equity market has thus far been sanguine. At the time of writing, opinion polls predict a significant victory for Labour. This is part of the reason why markets have been so calm in the lead up to polling day with the result appearing so settled. To date, the major political parties have refrained from making comments that could worry financial markets.

UK equities have made a solid start to 2024. There is a continuation of bid and takeover activity suggesting a continued interest in the attractive valuations of UK companies. For example, the board of financial services business, Hargreaves Lansdown, backed an offer from a private equity led consortium. A decision that has divided the opinions of major shareholders. In addition, albeit from a low level, new listings are materialising. Recent examples being Raspberry Pi, and, potentially, fast fashion purveyor, Shein.

The French Election

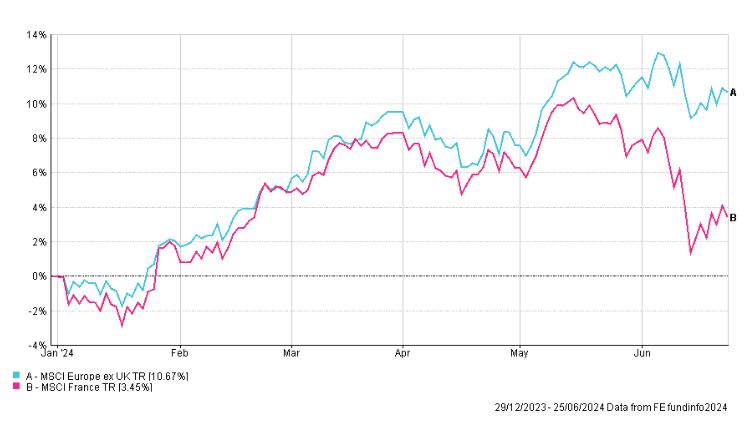

Circumstances in France are somewhat different. Following disappointing results in the European elections, President Macron called snap National Assembly elections, with voting to commence on 30th June. In contrast to the UK election, the announcement unsettled the local financial market.

Indeed, the market remains sensitive to the outcome of the elections. Investors are most concerned about the possibility of a successful result for parties on the far left or right of the political spectrum. In a boost for European investors, the European Central Bank moved ahead of the BoE and the US Federal Reserve in cutting interest rates. The deposit rate was cut from 4.00% to 3.75%.

Artificial Intelligence

Over in the US, both the S&P 500 and NASDAQ Composite indices continued to establish record highs. The pervasive theme of artificial intelligence is still driving investor interest in the world’s biggest technology companies. This has prompted an element of profit taking, seen more starkly in leading chip maker, Nvidia. The debate continues on appropriate valuations for stocks benefiting from the significant growth opportunities offered by the boom in artificial intelligence. Concerns about the overvaluation of companies such as Nvidia have been repeatedly quashed however as the company continues to report strong earnings results.

In line with the BoE, the US Federal Reserve held interest rates at 5.25%-5.50%. While inflation in the UK made a welcome return to target, inflation remains stubbornly above the 2% target rate in the US. Federal Reserve Governor, Michelle Bowman, noted that it is not the time to start lowering rates. More concerning for investors, the Federal Reserve did not rule out the possibility of an increase to interest rates should inflation fail to pull back to target.