Following a volatile period for investment markets, November was in comparison a more subdued month. In the UK, the first half of the month saw attention focused on the Autumn Statement delivered by Chancellor Jeremy Hunt to Parliament on 17th November 2022. While the statement looked to bring stability to public finances, it also evoked much debate over the lack of focus on growth.

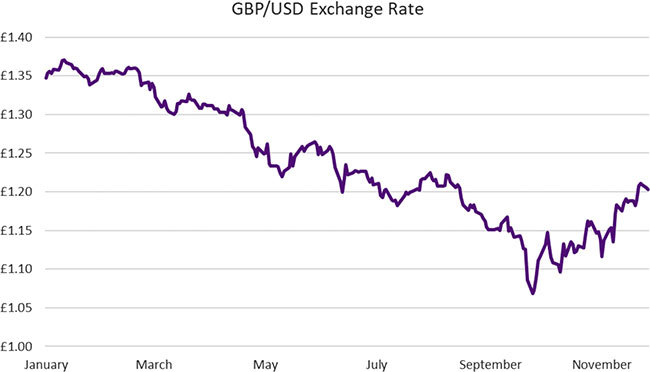

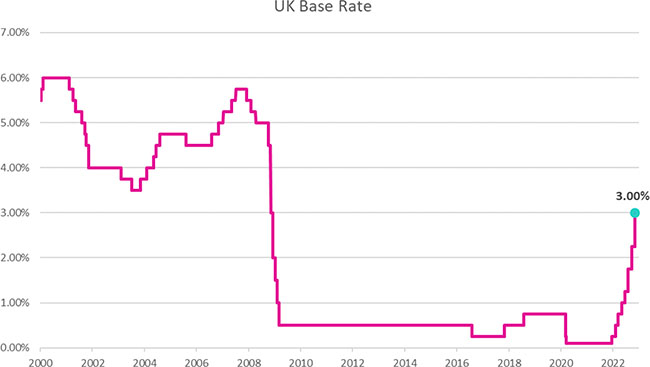

The highly topical Office for Budget Responsibility (OBR) has forecast that real incomes will fall by 7% over the next two years. This is a very significant decline for an economy strongly orientated to consumption. On a brighter note, the statement, whilst making unpalatable reading for taxpayers, had the desired impact of bringing stability to sterling denominated assets. Sterling mounted a recovery, with the cable rate reaching £/$1.20. In addition, gilt prices firmed. The widely watched 10-year gilts yield has moved below 3.10%, having spiked sharply following the contentious ‘Mini Budget’.

The Inflation Question

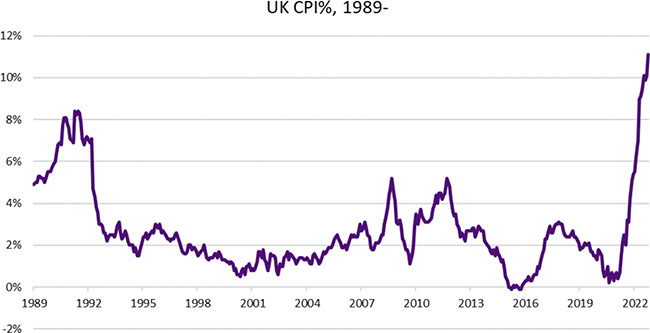

Inflation remains at the forefront of investors concerns. On a global perspective, the news has been somewhat mixed. Financial markets took encouragement from early, tentative, signs that inflation in the US economy may have peaked. The October 2022 reading of 7.70%, marked a notable decline from the previous month’s reading of 8.20%.

Both bond and equity markets rallied, on the assumption that receding inflationary pressures would temper the rate of monetary tightening from The Federal Reserve. These assumptions received some validity, following the release of The Federal Reserve’s November 2022 policy meeting notes. The notes suggest members prefer a gentler path of rate rises from the previous hikes of 0.75%. This saw the dollar give up some strength, and further helped sterling.

While key commodity prices and shipping rates have fallen notably, the inflationary landscape is not globally uniform. In Europe, pressures are more acute, given the war in Ukraine and the reliance on Russian energy. Meanwhile, in the UK, labour market dislocation is fuelling wage inflation and despite suggestions inflation was cooling in the US, inflation rose higher in the UK in October. The scale of industrial disputes has led to unflattering comparisons with The Winter of Discontent of 1978/79. Employers are in a tight spot, faced with sharply rising costs, there is a reluctance to lock in inflation matching wage increases. On the other side, one can understand the desire of employees to defend their standard of living. A wage price spiral is difficult to tame, without harming the overall economy.

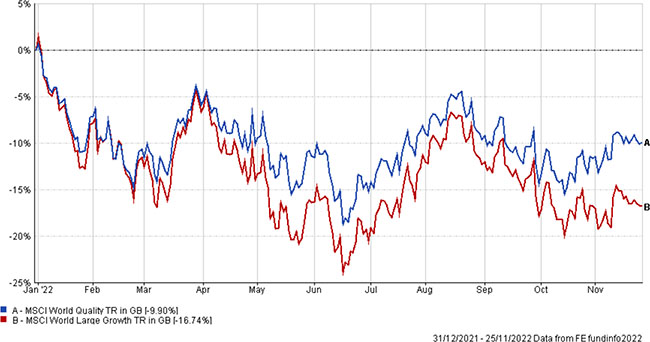

Corporate news has been mixed, but far from universally bad. Generally, revenues have held up, but margins have fallen, owing to the difficulties of processing unprecedented cost increases. The extent to which these can be passed on, is a function of the level of pricing power enjoyed by a business. With the cost of finance increasing, balance sheet strength is highly desirable. This is likely to lead investors to focus on quality, well capitalised businesses. Even if the external environment is challenging, good businesses survive, and often benefit from a Darwinian process, which sees less compelling propositions fail.

China Protests

While covid-19 has lost newsworthiness in The West, it has remained highly topical in China. China’s uncompromising zero-covid policies has significantly constrained the economy, and tested the limit of its society, regarding the loss of liberties resulting from reactionary lockdowns. Xi Jinping has staked his reputation on defeating the virus and has thus found himself in a very awkward position.

Despite a serious of draconian lockdowns, case numbers, while still modest by levels previously reported in The West, are rising. Furthermore, without a domestically produced efficient vaccine, and poor levels of take up, particularly amongst those considered vulnerable, Xi Jinping has few desirable options at his disposal. As investors, we must remain alive to developments in China, as they can have a profound influence on both the global economy, and the geopolitical landscape.

The world is a more fluid and less certain place than in past years. We face both challenges and opportunities. Despite near term difficulties, COP 27 served a powerful reminder that nations must work together and invest sustainably for the good of both the plant and humanity. Sound diversification, along with a patient, long-term mindset, will likely serve investors well.