The events unfolding in Eastern Europe over the past few days have caused shock waves throughout the financial markets.

Tensions between Russia and Ukraine had been increasing for some time, but the expectation was that any conflict would stop short of a full-on invasion. When the invasion went ahead, the market was taken by surprise, and we are now seeing volatility in indices across the world.

The FTSE 100, S&P 500, Dow Jones, and NASDAQ all dipped following the news. The Russian stock market has seen the steepest decline of all. If you are seeing some volatility in your investments, that is to be expected. Markets are very sensitive to world events as they are driven by investor sentiment. When the situation resolves, or at least the outcome becomes clearer, the market tends to correct itself.

Why does war affect financial markets?

There are a number of reasons why a conflict between Russia and Ukraine could impact the markets. For example:

- The sanctions imposed on Russia by the UK and the US could have a wide-reaching impact on global trade.

- Russia supplies a significant amount of gas to Europe. With energy prices already rising, a shortage could make things even worse.

- Businesses in the area could be vulnerable.

Financial markets tend to be volatile in the early days of any crisis as analysts try to anticipate what will happen next. This can create more uncertainty than the impact of the event itself.

Why you shouldn’t worry

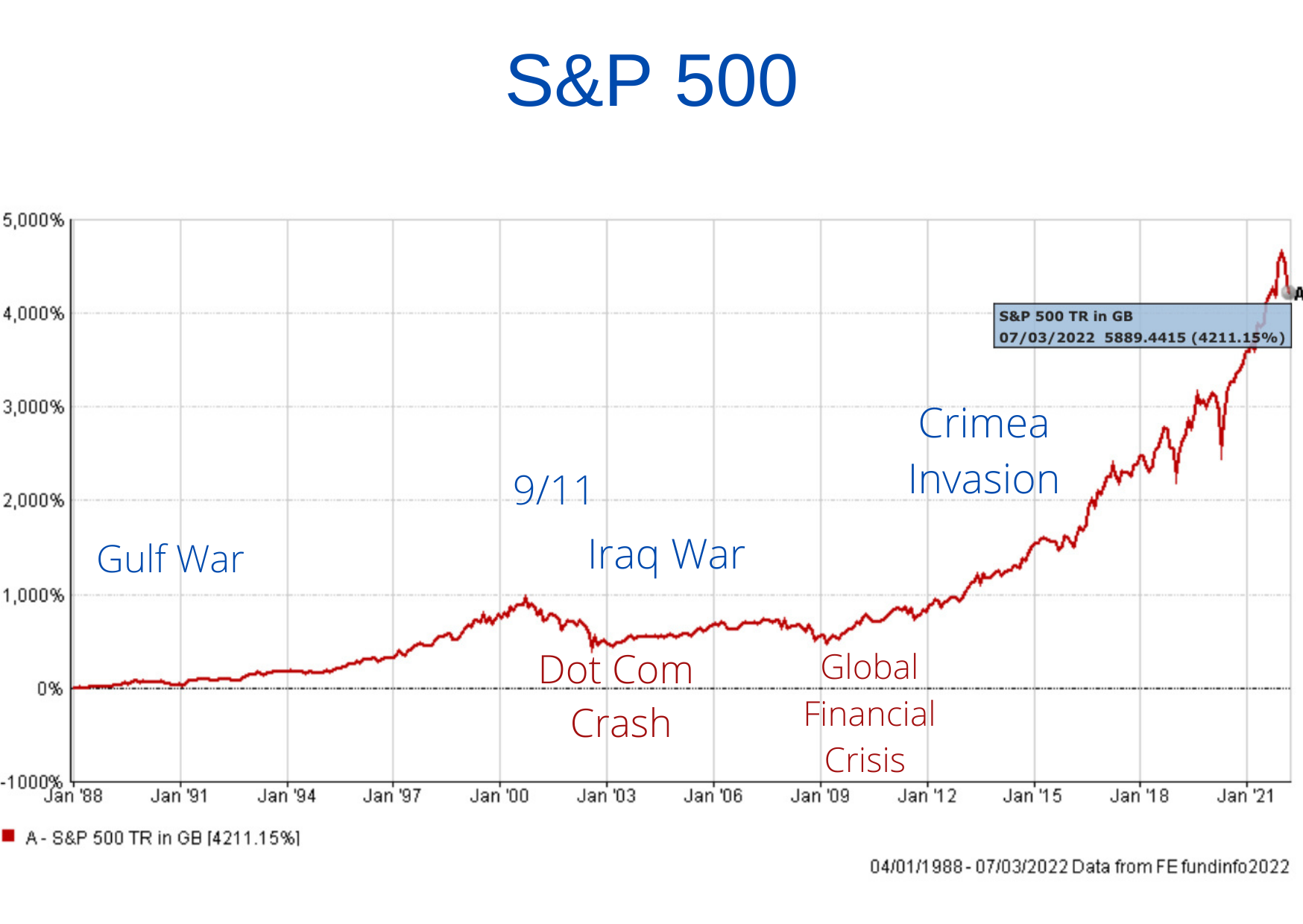

The economy is incredibly resilient and moves in cycles. The chart below shows the progression of the S&P 500 since the 1960s, throughout major world events:

As you can see, the dips caused by geopolitical events have been fairly minor, with a swift recovery. The exception to this was the period between 9/11 and the Iraq War. But the dot-com crash happened at around the same time and had a major part to play. This suggests that we need to look at the context of any conflict to see the full picture.

In this case, the timing has been unfortunate in terms of the financial markets. With the uncertainty of Covid-19 more or less behind us, the main concern ahead was rising inflation (largely driven by energy prices) and interest rates. Adding geopolitical uncertainty to the mix has not helped matters.

But longer term, it is possible that the sanctions imposed and potential reduction in growth could help to keep the overheating economy under control. If growth slows, inflation forecasts could reduce, and interest rate increases might not be as severe as expected. This is speculation at this point but illustrates how everything is interconnected and balance can eventually be restored.

If the market can recover from Covid-19 and the 2009 global financial crisis, it will recover from this.

What should I do?

The purpose of an investment strategy is to produce long-term growth regardless of what is happening in the market. The world is changing every day and the stock market can fluctuate on the whims of a billionaire making comments on Twitter. Over a lifetime of investing, there will be multiple bumps, but we need to keep our discipline and wait out the volatility. Our tips for investing successfully throughout a crisis are:

- Don’t be tempted to take money out. Markets recover quickly and this could mean missing out.

- Avoid trying to time the market as getting it wrong, even by a day, can mean you are worse off.

- Keep enough cash to cover your short-term spending and any emergencies.

- Invest in a diverse range of assets to avoid concentrating risk in one area.

- Continue with any planned or regular investments, as when prices dip you can buy more shares for your money.

At the time of writing, markets are already showing some early optimism, so it is possible that further improvements will follow.

Please do not hesitate to contact your Financial Planner if you would like to discuss any of the topics covered.

Reach us via:

t: 01228 210 137